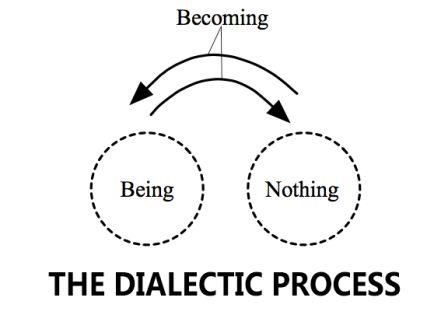

The dialectic process is the change that occurs due to some action, any act, or a process, and the responsible body is an opposing force. There are three main stages in the dialectic process, i.e., thesis, antithesis, and synthesis. The hypothesis is a set of arguments or rules necessary to carry out a process, as compared to the antithesis, which arises as the outcome when two opposing forces strike.

Introduction

The dialectical process is a way of thinking and debating that entails a planned interchange of ideas to comprehend a topic more deeply. It highlights how crucial confrontation and contradiction are to exposing the truth or a more complete picture.

The regulatory dialectics is purely linked to the financial institutions related to the cyclical interaction, and the political and economic causes play an opposing role. Financial innovation relates to the dialectic process and further works with interrelated factors.

The Reasoning of Dialectic Process

The dialectic process is often called dialectical reasoning or dialectical method. It is a method of inquiry and discourse that involves examining and resolving contradictions or opposing viewpoints to arrive at a higher truth or understanding. This links to the philosopher Georg Wilhelm Friedrich Hegel. He developed the dialectical framework as a fundamental aspect of his philosophical system.

The dialectic process can be seen as a three-step cycle: thesis, antithesis, and synthesis. Here’s a breakdown of each step:

- Thesis: The thesis represents a particular idea, concept, or proposition. It is an initial statement or position that is put forward.

- Antithesis: The antithesis is the opposing viewpoint or contradiction to the thesis. It challenges the thesis and presents an alternative perspective or idea that contradicts it.

- Synthesis: Synthesis is the thesis and antithesis resolution or reconciliation. It involves combining elements of both positions to form a new and more comprehensive understanding. The synthesis represents a higher truth that incorporates and transcends the contradictions of the thesis and antithesis.

The dialectic process is characterized by the continuous movement and development of thought through opposing ideas. It recognizes that contradictions and conflicts are inherent in human understanding and seeks to resolve them through critical examination and synthesis. The aim is to develop a more comprehensive understanding of the subject matter.

Core Aspects

The thesis is a presentation’s first claim, assertion, or concept.

The counterargument, critique, or opposing point of view that refutes the thesis is known as the antithesis.

The new insight or viewpoint resulting from the conflict between the thesis and the antithesis is the synthesis. It could be an entirely new concept, an improved version of the original thesis, or a mix of the two.

The Discourse Pattern

The dialectic process is not limited to philosophical inquiry but applies to various fields of study and discourse. It includes politics, sociology, and everyday conversations. It provides a framework for exploring complex ideas and examining different perspectives. Hence, it gives a more nuanced and comprehensive understanding of a subject.

It’s important to note that different philosophers and thinkers have interpreted and applied the dialectic process in various ways throughout history. While the general framework remains consistent, there can be variations in the terminology and specific steps involved. Nevertheless, the underlying concept of engaging with opposing viewpoints, resolving contradictions, and moving towards a higher truth or synthesis is at the core of the dialectic process.

Financial Innovation in Dialectic Process

The underlined factors are inflation, technology, regulatory environment, and perceived market conditions. The high inflation rate is directly related to the rise in interest, deficit, and exchange rates. Technology plays an integral role in stimulating the financial innovation of institutions. It refers to instruments such as electronic devices and computers.

It is all about telecommunication and the rapid development of technology in the financial sector. This leads to new communication approaches and better transmission systems, which need to speed up the process of information flow.

The Regulatory Environment shows the relationship between innovation and regulation and is present in historical events. They can lead to the occurrence of further developments. However, the change in the perceived conditions of the market in the financial institutions is market-driven.

These relate to the market and several products that the firm offers. The customer always demands and pays for the product, while the firm seeks revenue, development, and profitability. When discussing dialectic processes related to financial institutions, there is always a market role in regulation.

Society is burdened with the tensions and contradictions related to market processes and financial innovation. Georg Wilhelm Hegel, a German Philosopher, started the dialectic process.

Different Forms of the Dialectical Process

Socratic Dialogue

In this traditional format, an adept interrogator (often Socrates) uses incisive questions to reveal weaknesses and contradictions in a rival’s argument. This causes the subject of the inquiry to reconsider their opinions and could perhaps lead to a fresh realization.

Hegelian Dialectic

This form, which was created by Georg Wilhelm Friedrich Hegel, highlights the underlying inconsistencies in thoughts or ideas. These “dialectical moments,” or paradoxes, are what propel evolution and change. Hegel put forward a three-phase framework:

Abstract: The original concept or assertion, is frequently oversimplified.

Negative: An alternative viewpoint or criticism that casts doubt on the abstract.

Concrete: A more thorough comprehension that considers both sides, resulting from the tension between the negative and abstract.

Material Dialectic

This style, which was first presented by Karl Marx and Friedrich Engels, focuses on the inconsistencies that exist in social and economic systems. They held that historical development and societal advancement are propelled by these contradictions, much like the class conflict between the bourgeoisie and proletariat.

Benefits of the Dialectical Process:

Questioning presumptions, analyzing competing views, and drawing well-reasoned conclusions are all encouraged by critical thinking.

Novel Concepts: The collision of viewpoints can inspire imagination and give rise to fresh, original concepts.

Deeper comprehension: A more complex and thorough comprehension of a subject can be attained by sifting through contradicting facts.

Solving Problems: Solutions that take into account the advantages and disadvantages of each side can be developed by recognizing and evaluating conflicting points of view.

Dialectical reasoning involves more than just selecting a “winner” for a discussion. It involves carefully analyzing many points of view to get a complete picture. This method is still applied today to promote intellectual advancement and initiate fruitful conversations in a variety of domains, including critical analysis, education, and philosophy.

Bottom Line

The dialectic process affected historical bank performances in 1970 because applying economic and political forces affects cyclic interaction. This is why firms develop some rules for their benefit and to benefit other financial institutions to capture a large part of the market.

The regulatory system is evident from the many former firm’s performances, and the role is apparent by commercial banks. Banks regulate and protect by entering new firms to promote stability and capture a particular geographic market.

From the dialectic behavior and the primary operating economic and political forces. Hegel had presented correct notions. These were about the thesis, dialectic thesis, antithesis, and synthesis.

The argument creates forces that yield antithesis, and synthesis resolves the associated tension. This is how processes show interlinking and dialectic processes play a significant role for financial institutions.